Blog

How investment charges can impact long term investment returns

Today, 73% of high net worth individuals assign a high importance to fee transparency, according to Capgemini, and they expect fair pricing across the board.

Investors frequently raise the issue that obscure and additional fees can hinder their investment performance, and thus their financial goals. However, many fear the hassle or additional expenditure that would arise if they were to change wealth managers.

Understanding the breakdown of the fees

Fees are an increasingly topical subject, not least owing to the FCA’s new guidelines on fee transparency. Whilst this goes some way to making it easier to draw comparison, investor do not always find it easy to compare apples with apples.

Understanding the subtle yet fundamental fee distinctions makes a world of difference in how you approach handling your wealth. Take for example, the difference in service offerings between a wealth manager and financial advisor and their subsequent charging structure.

Although financial advisors can manage your investments as well as providing financial advice, 90% (according to ftadviser) opt to outsource this to a Discretionary Fund Manager, typically a wealth manager by another name. Yet, at the same time they continue to charge their clients an annual fee for advice, typically around 0.8% – 1.0% per annun.

This differs from a wealth manager in that wealth managers will usually always offer several services under one roof to ensure you’re working with the same people to handle all aspects of your net worth. They may charge an investment management fees of around 0.8% – 1.2%, or a wealth management fee, which would include financial advice and/or planning for an additional 0.3% to 0.5%, and as such often results in considerably lower fees, typically around 1.2% -1.5% for both on accounts up to £1m and reducing thereafter.

To further complicate things, wealth manager often present two different charging structures for investment management. Firstly a combined annual fee, which includes any subsequent commission, custody, admin etc or secondly a basic annual fee with commission, custody, admin added on after. In addition to this, you must consider the ongoing charges for any underlying investment funds.

Why is this so important?

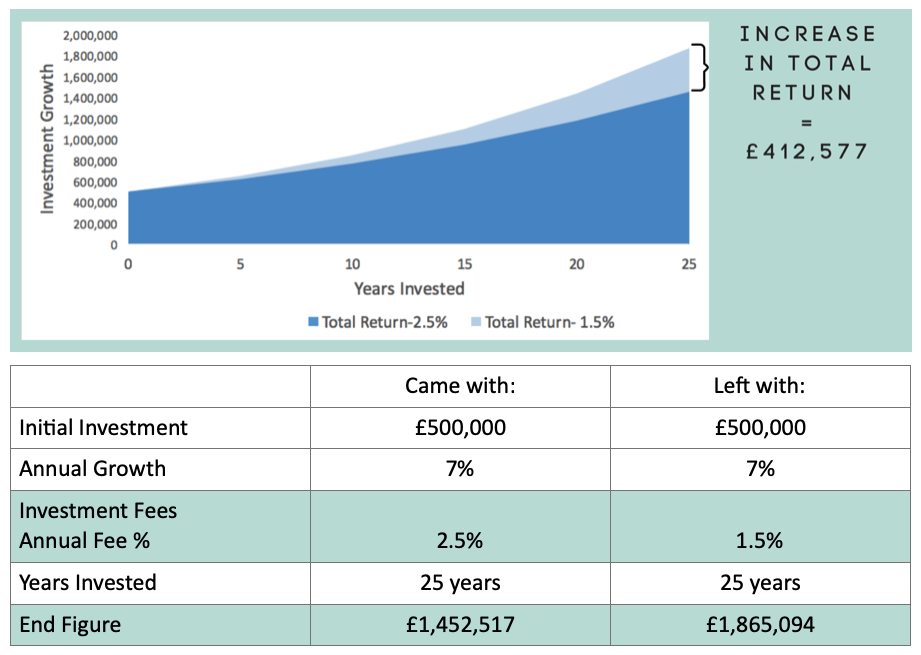

Compounded total returns from your investment add growth to your investment fund, overtime this can be a significant. A simple 1% reduction in annual charges could make all the difference to your financial freedom.

If you invest £500,000 as a lump sum, with a 25 years investment horizon, targeting 7% annualised return gross of fees, and with a fee saving of 1%, your investments could benefit by £412,577, as illustrated on the chart below. To do your own personal calculations, visit our free investment fee calculator here.

How to bring costs down?

Fortunately, there are a number of options for investors to consider with regards to reducing their fee.

1. Review arrangements with your existing IFA or Wealth manager

As outlined above, review your existing arrangements. Are you getting the service you need to meet your specific requirements, or are you paying for something that no longer brings you any benefit?

Be sure to understand the full extent of what you are paying, including underlying fund charges. It is worth considering whether it is really necessary to continue paying a retainer for your IFA, if it can be done more cost effectively by a wealth manager?

Whilst The Wealth Consultant advocates financial advice, it does not endorse the practice of paying an annual fee to retain a financial adviser, and prefers financial advice to be sought as required.

2. Understand Exit Fees

When considering a change in wealth manager, investors can be wary of exit fees. Some investment providers charge up to 5% if an investor exits within five years of taking out the plan.

Most reputable and transparent wealth managers that we work with will retain their clients based upon the value added service rather than force. However where exit fees do apply, It is also worth exploring if your new wealth manager would be willing to absorb some of these for you.

3. Negotiate

Don’t be afraid to negotiate. You will often find there is some room for manoeuvre, especially on larger accounts. If you still don’t like what you are paying, shop around.

4. Go Robo

Typically, digital wealth is cheaper than services offered by a discretionary wealth manager, although again this can vary quite considerably from platform to platform. Our guide “Going Robo” takes a closer look at digital wealth and the select few digital wealth managers that are on our platform. Read here

How can we help?

Regardless of your wealth, we believe that everyone should have access to professional investment advice, at a fair price. Giving you peace of mind that your financial wellbeing is in good hands.

The Wealth Consultant can help you find a suitable Wealth Manager to protect your long term investment returns from being eroded by excessive fees. We will make it personal to you, whatever your circumstances.

Contact Us Now so we can match you with and introduce you to three wealth managers, simply and free of charge. Let us find you the right wealth manager.