Savings

Money saving experts

Are you thinking about saving some money for a rainy day? Saving is an important step towards achieving future aspirations. However, with a plethora of different routes to saving, many feel uncertain about the best ways to save.

From finding the right balance between monthly income and how much to save each month, to deciding on the best place to invest your hard-earned savings, it’s easy to feel as though you aren’t making the right progress with your savings.

Seeking independent financial advice from a wealth manager is a great way of gaining that all-important confidence needed when investing and saving your money for the future. They can help you to establish a clear picture of your financial circumstances, identify your goals and create a realistic plan that puts you on the right track to achieving your financial and saving ambitions.

Choosing the right wealth manager who will offer the right style of planning and assistance is not always easy. Here at The Wealth Consultant, we have established long-standing partnerships with a wide network of wealth managers who have specific expertise in offering savings and investment advice. We can introduce you to an independent advisor from our network of wealth managers, based on your individual needs and requirements.

It’s not about timing the market, but time in the market.

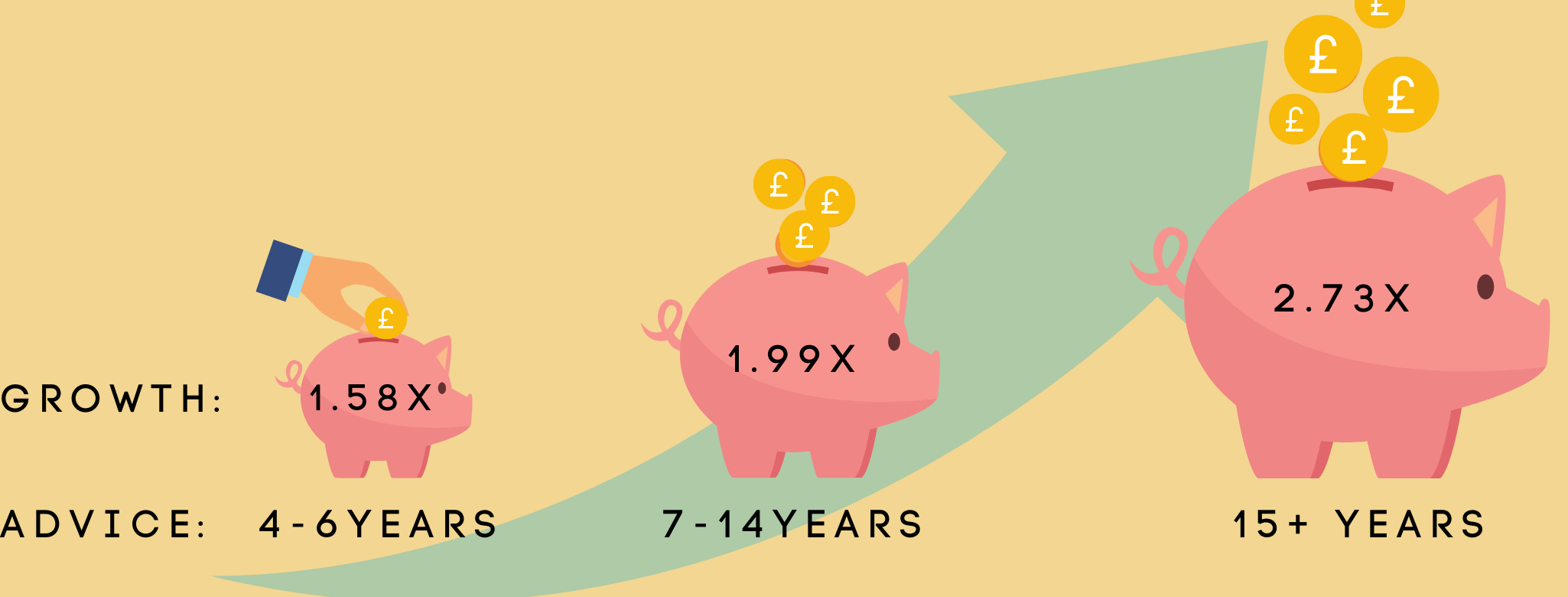

The average household over 15 years can grow there assets 2.73 times larger than those unadvised. (IRIS,2018)

At The Wealth Consultant, we remove the time-consuming hassle of searching out financial products and advisers. We consistently introduce our clients to the best wealth managers to meet their specific needs, who can give you access to leading investment products and cash solutions to ensure that you are not affected by bank account inertia.

How is the UK saving money?

According to research by Finder, around 15% of Brits have no savings at all, whilst 75% of people have some form of a financial plan that involves saving money. So what are others doing to save their money for a rainy day?

In the past few years, Stocks and Shares ISAs have taken the spotlight. In 2018, 2.8 million accounts were active, with more than £28 million invested.

Whilst Cash ISAs remain popular, over the past four years there has been a decline in the number of people opting to save in this way. The amount of money invested in Cash ISAs dropped from £60 million to £40 million from 2015/16 to 2017/18. This indicates that we are diversifying across different investment vehicles.

In addition to Cash and Stocks and Shares ISAs, there is a wide spectrum of ways to begin saving when working towards our wealth ambitions. A wealth manager can help you to confidently identify how and where to save your money.

How we can help

Many of us find it difficult to find a good balance between saving and everyday spending, as well as choosing the best place to put our saved money to maximise upon our growing wealth.

A savings plan tailored to you

The Wealth Consultant can help by pairing you with a wealth manager who has specific expertise in financial planning and savings. Whether you are looking to start a short term saving plan for a car, wedding or trip, a longer-term saving for retirement or for your children’s education or future, your wealth manager can provide you with the support and know-how needed to achieve your saving ambitions.

Independent expert advice on where to save

Here at The Wealth Consultant, we can introduce you to a wealth manager who can offer independent expert advice on how and where to save your money. Your wealth manager can help you to establish a healthy and realistic balance between supporting your current lifestyle and reaching your saving goals based on your income and outgoings.

Once you have a plan for how much you’d like to save, your wealth manager is on hand to share their broad spectrum of up to date knowledge of the investment and banking industry to support you when choosing the best place to save your money.

They will help you to compare savings accounts and investment options so that you can identify where you can reap the benefits from the best interest and account rates and weigh up the pros and cons of the options available to you. If you are interested in ethical investment, we can introduce you to specialist ESG advisors in order to support you in ensuring that your funds are placed in the most appropriate places.

In some circumstances, you may wish to split your savings across multiple saving schemes. Our wealth managers can assist you in getting the very best out of your savings by helping you to decide on the best ways to invest and protect and grow your wealth.

How we work

Our transparent and client centric structured wealth management process offers you peace of mind knowing that we use specialist industry knowledge to find the perfect wealth manager for you, free of charge!

Answer 10 simple questions about your situation and requirements. This will take no longer than 3 mins.

The Wealth Consultant will call you within 24 hours to clarify your details and discuss your matched wealth managers with you.

The Wealth Consultant will introduce you to, and arrange a time for an initial call, in order to choose the right wealth manager for you.

Dedicated Wealth Manager for you

Time to stop searching. Let The Wealth Consultant do the hard work for you. Get in touch today for a free consultation and digital introduction to the most appropriate wealth manager for you.