Blog

Financial advice during your relationship breakdown

Helping you find the right path

We understand that a relationship breakdown can be a difficult time. No doubt you will be thinking carefully about what happens now as well as in the future, and there will be some important steps that you may wish to take. One of these will be taking appropriate legal advice from an experienced family solicitor.

Whilst your solicitor can help to identify assets owned jointly within the marriage or separately by yourself and your former partner, and advise you on a fair settlement in your circumstances, they will not be able to give you financial advice.

Two key areas of support

Our wealth advisers play two distinct roles:

A Financial Planner – this specialist supports the financial proceedings in areas such as disclosure of assets, income planning, pensions, personal protection, tax, allowances, benefits, retirement and passing your estate on to loved ones.

An Investment Manager – this specialist typically builds an investment portfolio after divorce and can help you achieve your long-term goals through the ongoing management of your investments through targeting growth, income or both.

Helping you achieve your preferred outcome

It is in your best interests to explore your financial circumstances as early as possible when a relationship ends. A fair split of assets is likely to be important to you, as will your future income needs. Depending on your circumstances it may be appropriate for you to obtain financial advice from a qualified wealth adviser. Our advice to you can span four distinct phases to help you achieve the best possible outcome

1.) When you instruct your solicitor

When you are ready to visit your family solicitor for the first time, we can help you build a picture of your existing income and assets, as well as your future capital and income needs. This can make the appointment with your solicitor both time and cost effective. A cashflow analysis for example can help inform your decisions and can be used to support any financial claim you make in court or during dispute resolution proceedings, as well as help you achieve a fair split of your assets with your partner.

2.) Financial disclosure

During the separation, you are likely to be asked by your solicitor to disclose your assets. There may be cases where some of your assets as well as those belonging to your former partner are complex and difficult to value. We can help you put together a list of assets that will need to be disclosed during the financial negotiations, and work with you and your solicitor in providing a clear explanation and valuation of investments such as stocks and shares, pensions and other financial assets

3.) Negotiation and financial remedy

Upon the exchange of financial information, we can provide opinion on pensions and help you understand the complexity of their valuations. We can use more detailed cashflow forecasting to help determine a suitable settlement figure. We can help establish your tax position and give advice on the most tax-efficient way for you to manage your assets in settlement negotiations. We can also help you identify types of protection to help maintain your future financial needs.

4.) Post-settlement

After your financial claim has settled, you may need to consider investments, pension planning and the implementation of orders, tax and other major financial issues for the first time. We recognise this can be daunting and so we look to make this as easy as possible for you.

Pensions advice from a pensions expert

A pension is increasingly one of the largest financial assets from a marriage. Apportioning pension assets equitably between you and your former partner, and helping you navigate the complexities of the wide variety of options available, is something we can assist with. We can then also advise upon suitable future pension arrangements that you may need in order to give you long term security into your retirement.

Valued by clients, trusted by lawyers

Brewin Dolphin is one of the UK’s leading investment management and financial planning firms with 30 offices through the UK, Channel Islands and Ireland. For over 250 years we have been helping clients achieve their long-term financial goals and today we are entrusted with over £42 billion of their money. Our success has been built on the strength of our relationships with our clients. Personal service is central to everything that we do.Our family law team of wealth management advisers work closely with family solicitors and actuaries to help people going through a relationship breakdown make informed choices about their financial circumstances.

Our fair and transparent charges

You can take confidence from the fact that while we spend time getting to know you, we don’t charge for anything until we have been engaged by you. There are no hidden penalties, charges or commissions. For full fee information regarding Brewin Dolphin’s Financial Planning, Investment Management and Wealth Management services, rate cards are available upon request.

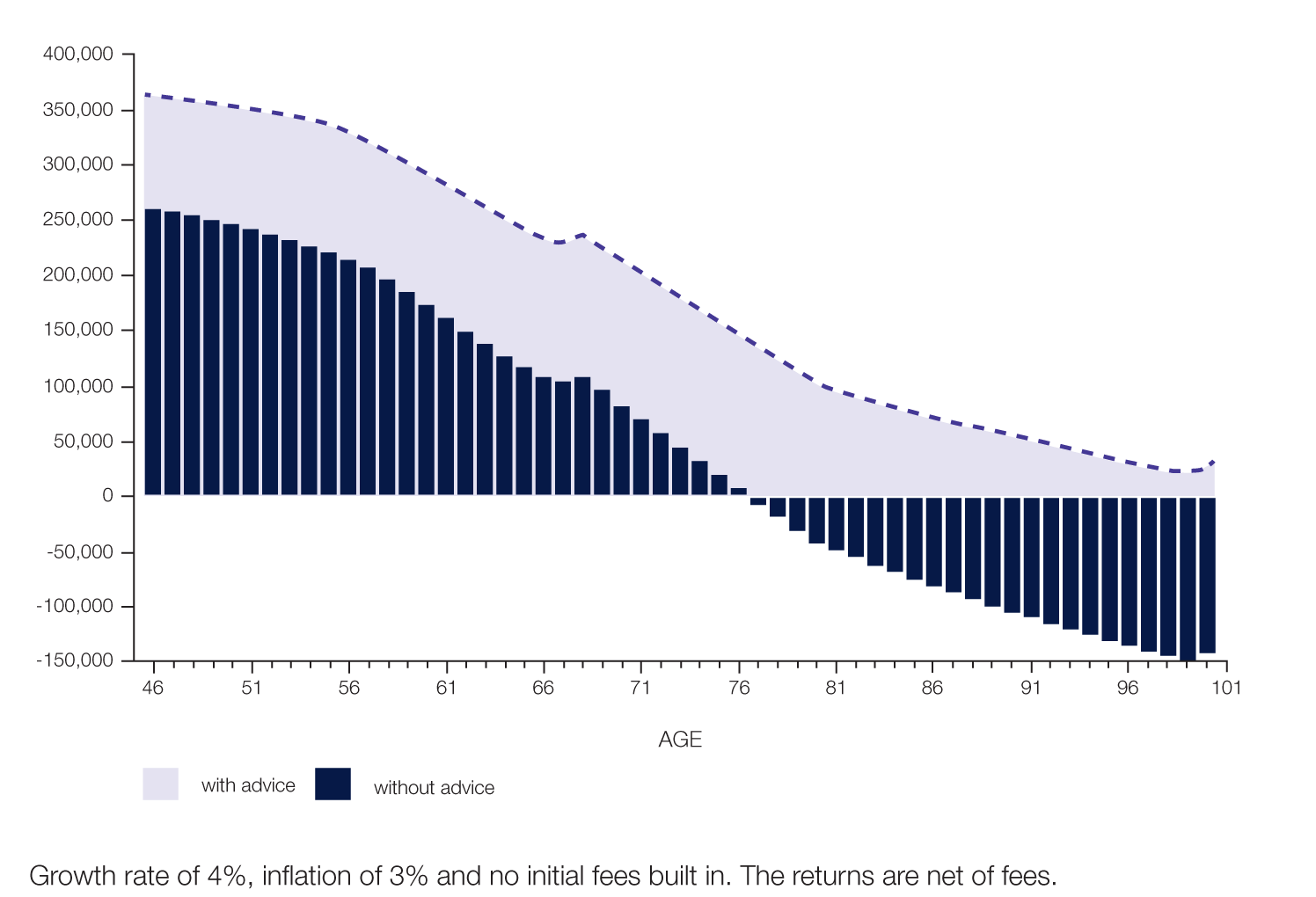

Cashflow planning/capitalising lump sums

Conducting a cashflow planning exercise is an effective way of understanding what your income needs and finances might look like following a financial settlement. The analysis considers income, expenditure, capital requirements and budgets relevant to the financial settlement process and then presents you with different options and informs your settlement scenarios.

Cashflow forecasting can help answer important questions such as: Will I have the same standard of living after my divorce? The graph below demonstrates the difference when you receive advice during your financial settlement. The example shows income runs out at age 77, without advice

Brewin Dolphin: Financial Advice Relationship booklet – Download